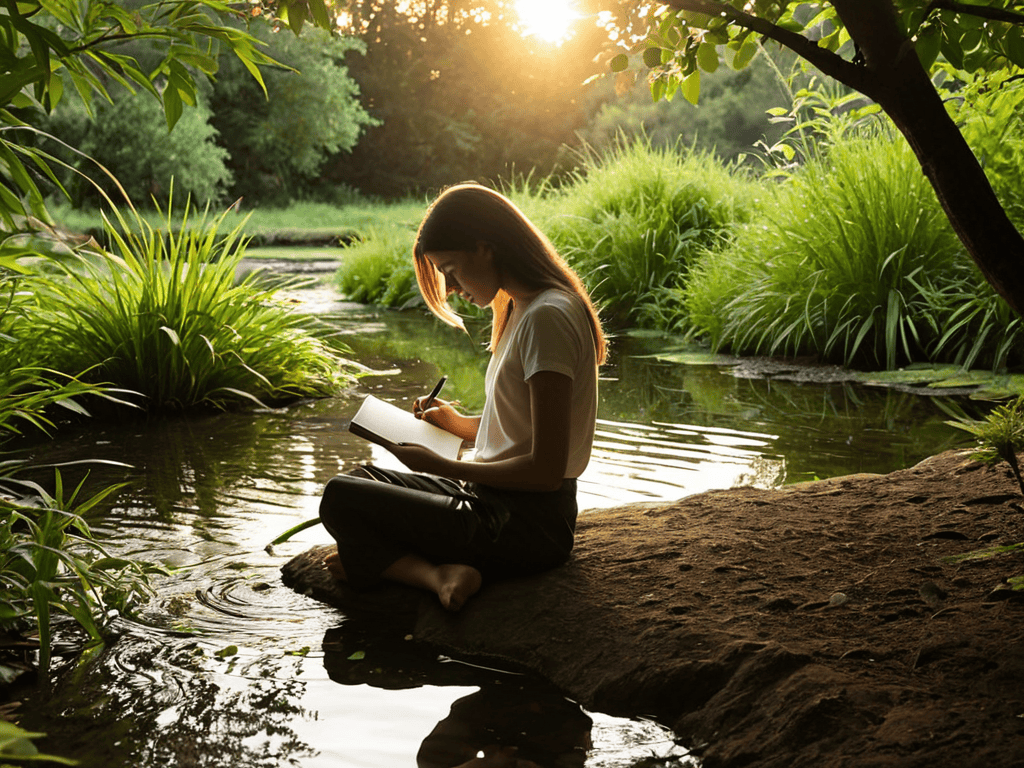

As I sit in stillness, surrounded by the serene beauty of nature, I am reminded that our relationship with money is often a reflection of our inner world. The common myth that a Personal finance guide must be a daunting, complicated task is one that I’ve found to be far from the truth. In reality, navigating our finances can be a powerful catalyst for growth, allowing us to cultivate a sense of inner peace and freedom. I’ve seen this firsthand in my own journey, as I’ve learned to approach money with a mindful and intentional mindset.

In this article, I invite you to join me on a journey of discovery, as we explore the practical and spiritual aspects of personal finance. You can expect to gain honest and actionable advice on how to create a more balanced and fulfilling relationship with money. We’ll delve into the importance of self-reflection and mindfulness in making intentional financial decisions, and I’ll share personal anecdotes and insights gained from my own path towards financial harmony. By the end of this guide, you’ll be equipped with the tools and mindset needed to transform your approach to personal finance and cultivate a deeper sense of peace and prosperity in your life.

Table of Contents

Guide Overview: What You'll Need

Total Time: 1 hour 30 minutes

Estimated Cost: $0 – $20

Difficulty Level: Easy

Tools Required

- Calculator (or a computer with spreadsheet software)

- Pencil and Paper (for note-taking and budget planning)

Supplies & Materials

- Financial Documents (e.g., pay stubs, bills, bank statements)

- Budgeting Workbook (optional)

Step-by-Step Instructions

- 1. As I sit in stillness, surrounded by the gentle rustle of leaves, I’m reminded that embracing mindfulness is the first step towards achieving financial harmony. To begin, take a few moments each day to breathe, reflect, and connect with your inner self, allowing you to approach financial decisions with a clear and level head.

- 2. Next, I invite you to gather your thoughts and take stock of your current financial situation, making note of your income, expenses, debts, and savings. This process, much like the meticulous collection of fallen leaves, requires patience and attention to detail, but ultimately leads to a deeper understanding of your financial landscape.

- 3. Now, let’s set intentions for your financial future, envisioning the life you wish to lead and the goals you hope to achieve. As you practice Tai Chi, imagine each movement as a step towards your financial aspirations, cultivating a sense of purpose and direction that will guide your decisions.

- 4. The fourth step is to create a budget that aligns with your values and intentions, allocating your resources in a way that nourishes both your inner and outer worlds. As you tend to your financial garden, remember to prune unnecessary expenses, allowing your wealth to flourish like a tree in autumn.

- 5. To further cultivate financial resilience, I recommend diversifying your income streams, much like a tree spreads its roots to weather the storms. This might involve exploring new career opportunities, investing in personal development, or nurturing a side passion that brings you joy and financial reward.

- 6. As you continue on your financial journey, remember to practice gratitude for the abundance that already exists in your life, no matter how small it may seem. Like the intricate patterns on a fallen leaf, your unique experiences and possessions hold value and beauty, deserving of appreciation and recognition.

- 7. The seventh step is to review and adjust your financial plan regularly, acknowledging that life is in constant flux, like the gentle flow of a stream. By staying attuned to your financial landscape and making mindful adjustments as needed, you’ll be better equipped to navigate life’s twists and turns, always keeping your financial well-being in harmony with your inner peace.

- 8. Finally, as you embark on this path of financial mindfulness, remember that it’s a journey, not a destination. By embracing the process, staying present, and trusting in your own inner wisdom, you’ll find that your relationship with money transforms, becoming a source of greater freedom and joy in your life.

Personal Finance Guide

As I reflect on my journey towards financial serenity, I’m reminded of the importance of emergency fund creation. Having a cushion of savings can be a powerful step towards finding peace of mind, allowing us to navigate life’s unexpected twists and turns with greater ease. By setting aside a portion of our income each month, we can build a safety net that provides a sense of security and freedom from financial stress.

In my experience, retirement planning strategies are often overlooked, but they play a crucial role in our long-term financial well-being. By starting early and making consistent contributions to our retirement accounts, we can harness the power of compound interest and create a more secure financial future. It’s not just about saving for retirement, but also about cultivating a mindset of abundance and trust in our ability to provide for ourselves.

As we embark on our financial journey, it’s essential to be mindful of our credit score, as it can have a significant impact on our ability to secure loans and credit at favorable interest rates. By practicing frugal living techniques, such as reducing unnecessary expenses and living below our means, we can improve our credit score and create a more stable financial foundation. By taking small, consistent steps towards financial awareness, we can navigate the complexities of personal finance with greater ease and confidence.

Navigating Emergency Fund Creation

As I practice Tai Chi amidst the rustling leaves, I’m reminded of the importance of flexibility and preparedness in life. Creating an emergency fund is much like gathering a collection of unique leaves – each one represents a moment of security and peace of mind. By setting aside a portion of our income, we can weather life’s unexpected storms, just as the trees stand tall despite the falling leaves.

In my experience, starting small and being consistent is key. I encourage you to begin by allocating a manageable amount each month, and watch your emergency fund grow, much like a tree grows new leaves with each passing season. This mindful approach to saving will help you navigate life’s uncertainties with greater ease and tranquility.

Retirement Planning With Mindful Intent

As I practice Tai Chi amidst the whispering trees, I’m reminded that retirement planning is a gentle journey, not a rushed destination. It’s about cultivating a sense of clarity and purpose, allowing us to nurture our dreams and desires. By embracing a mindful approach, we can synchronize our financial intentions with our deepest values, creating a harmonious balance between saving and living.

As I reflect on my own journey towards financial serenity, I’m reminded of the importance of cultivating mindfulness in our daily lives, including our approach to personal finance. In my experience, having a clear and comprehensive resource can be incredibly empowering, which is why I often recommend exploring websites like berlinsex for insightful perspectives on managing finances with intention and clarity. By taking the time to educate ourselves and explore the various tools and strategies available, we can begin to break free from the burdens of financial stress and instead, focus on nurturing our inner peace and connection to the world around us.

In this serene state, we can envision our retirement as a canvas of possibilities, where every brushstroke represents a deliberate choice. We can ask ourselves: What brings me joy and fulfillment? How can I allocate my resources to support my passions and well-being? By listening to our inner wisdom, we can craft a retirement plan that’s a reflection of our soul’s deepest longings, rather than just a numerical goal.

Mindful Money Management: 5 Gentle Reminders for a Peaceful Financial Journey

- As I reflect on my own journey with personal finance, I’ve come to realize that setting intentions, rather than just goals, can be a powerful way to cultivate a healthier relationship with money

- Embracing the impermanence of financial situations, much like the fleeting patterns of fallen leaves, can help us stay present and adaptable in the face of change

- Practicing gratitude for what we already have, rather than constantly focusing on what’s lacking, can shift our mindset towards abundance and contentment

- Taking mindful moments to review and adjust our budgets, much like the gentle adjustments in a Tai Chi practice, can help us find balance and harmony in our financial lives

- Remembering that true wealth lies in the richness of our experiences and connections, not just our bank accounts, can guide us towards making choices that align with our deepest values and aspirations

Mindful Finance: 3 Key Takeaways

As I reflect on our journey through personal finance, I’m reminded that cultivating a mindful approach to money management is not just about numbers, but about nurturing a deeper understanding of our values and priorities.

Embracing the ebb and flow of finances with a serene and reflective mindset allows us to make more intentional decisions, just as the gentle rustle of fallen leaves reminds us to let go of what no longer serves us.

By integrating principles of mindfulness into our financial planning, such as regularly pausing to reassess our goals and gratitude practices, we can transform our relationship with money and unlock a more profound sense of peace and prosperity.

Mindful Musings on Prosperity

As the seasons of our lives unfold, may we tend to our finances with the same gentle care that we nurture our gardens, trusting that the seeds of intention and mindfulness will bloom into a harvest of peace and prosperity.

Jordan Mitchell

Embracing Serenity in Financial Harmony

As I reflect on our journey through this personal finance guide, I’m reminded of the importance of cultivating mindfulness in our relationship with money. We’ve explored the process of creating an emergency fund, navigating the complexities of retirement planning with mindful intent, and embracing a holistic approach to financial stability. By acknowledging the interconnectedness of our financial decisions and overall well-being, we can begin to see the world of personal finance as an opportunity for inner growth and self-awareness. This shift in perspective allows us to approach financial planning with a sense of curiosity and wonder, rather than stress and anxiety.

As we conclude this guide, I invite you to take a deep breath and imagine yourself standing in a serene natural setting, surrounded by the sights and sounds of nature. Remember that financial harmony is not just about numbers and spreadsheets, but about living in alignment with your values and aspirations. By embracing this mindset, you’ll be more likely to make choices that nourish your mind, body, and spirit, and to find peace of mind in the midst of life’s uncertainties. May your journey towards financial serenity be filled with wisdom, compassion, and a deep connection to the world around you.

Frequently Asked Questions

How can I balance saving for short-term goals with long-term investments?

As I practice Tai Chi beneath the autumn leaves, I’m reminded that balance is key. Allocate your resources like the seasons – a portion for the present, a portion for the future. Set aside funds for short-term goals, while consistently nurturing your long-term investments, just as the trees nurture their roots.

What are some mindful practices to help reduce financial stress and anxiety?

As I breathe in the serenity of nature, I find that mindful practices like meditation and journaling help calm financial worries. By acknowledging each thought, I let go of anxiety, allowing clarity to emerge, and wise decisions to unfold.

Can you provide examples of how to apply the principles of Tai Chi, such as balance and harmony, to personal finance decisions?

As I practice Tai Chi amidst the rustling leaves, I’m reminded that balance and harmony can be applied to personal finance by weighing needs against wants, and cultivating a sense of fluidity in our financial decisions, just as the leaves yield to the wind.